TYPES OF TRUSTS

Family, Parallel, Single, Inheritance, Business & Charitable Trusts

What are the various types of Trusts that are used today and why?

There are specific reasons why, when a Trust is established, serious thought is given to the clients ‘end game’.

Too many Trusts have been created in the past without any thought given to what the clients want and how, practically speaking, the Trust will actually work under various scenarios that may play out in the future.

The six main types of Trust are:

- Family Trust

- Parallel Trusts

- Single Trust

- NextGen Trusts (Inheritance)

- Business Trust

- Charitable Trusts

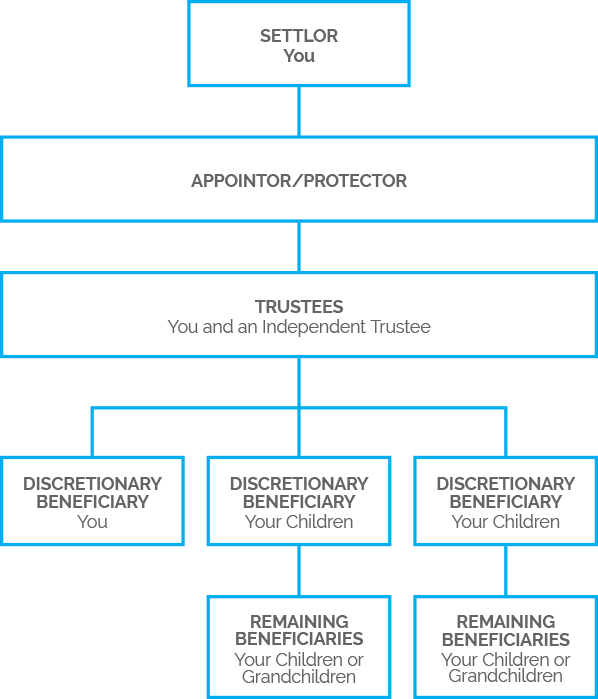

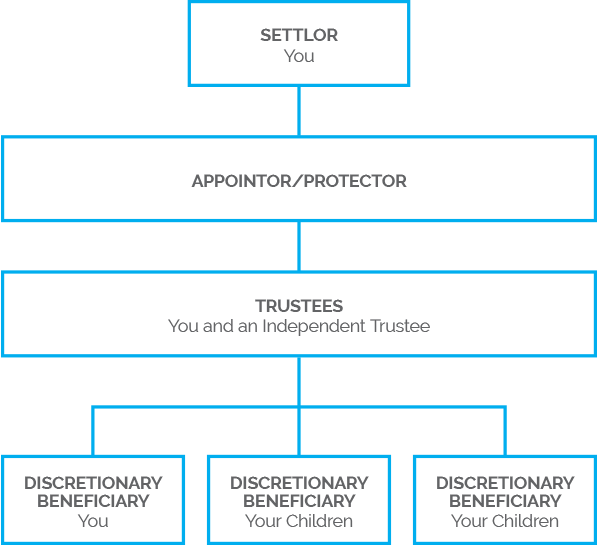

A Family Trust is the foundation of almost every asset protection and succession planning structure. It will be used as a base document to protect your family’s lifestyle and retirement assets and to allow for any changes that may occur in your life.

The Family Trust is generally used by a couple either married or in a de facto that has combined assets of equal values and generally do not have children from any other relationship. Family Trusts will generally hold a Family Home, Investments a holiday home etc.

For asset protection

If you own assets and perceive that these could be put at risk or could have some potential for loss, then a Family Trust is for you.

A Family Trust will allow you to remove these assets from your ownership but still retain enjoyment and benefit from them. Trustees will hold these assets in a Family Trust on behalf of the family group.

The rationale for establishing a Family Trust includes ensuring your assets will be handed on to your family.

For protection from creditors

We are a country of small businesses, subject to the vagaries of business including voracious creditors. If a business should not trade successfully, creditors have recourse to your personal assets.

However, assets protected and ring fenced in a Family Trust will, in most cases, not be available to business creditors. Without such protection your hard earned assets can be subjected to claims from creditors and if successful, you may well lose them.

For retirement planning advantages

Building assets for retirement can be a wasted exercise if those assets are subject to loss. A Family Trust can protect them so they are available when needed for retirement. Use of a Family Trust may also maximise tax advantages thus making the retirement dream that much more achievable.

Modern Trusts will allow control and access by retirees to income and capital if needed from their Family Trust, often with advantageous income splitting benefits.

For protection of assets for future generations

One of the great joys of parenthood and grandparenthood can be passing wealth to future generations to help them along life’s highway. For many families, their wealth has been passed from Family Trust to Family Trust, thus preserving it and ensuring the protection of Trusts is working for them over the decades. An inheritance should only be received by a Trust created specifically for the individual child who was to inherit the funds in the first place.

Regrettably relationships do fail and inherited wealth can pass to the estranged partners of family members if the protection afforded by Trusts is not used. Who really wants the former partner of a family member making claim on assets you have worked hard to accumulate?

For tax planning benefits

When income is received in a Trust, the Trustees can elect how it is allocated –to retain it in the Trust or distribute some or all to beneficiaries.

When such decisions are made Trustees should take into account the tax rates applying to beneficiaries and in many cases, this will result in savings of tax.

Maximising tax efficiency should be a consideration of the Trustees and can often result in considerable tax savings.

Whilst income from personal exertion (wages and salary) cannot be diverted to Trusts, investment income can be by transfer of the income earning assets to a Trust. Under current tax rates having that income taxed at the Trustees’ rate of 33% (or lower if distributed to beneficiaries in some instances) is preferable to having that income taxed at the current highest tax payer’s rate of 38%. When these rates change on 1st October 2010, distributing to lower tax rated beneficiaries will become more tax efficient.

For peace of mind with your Family Trust…

EXPERIENCE & EXPERTISE

We have over 50 years combined experience in trust and estate planning and can attend to all your administrative requirements.

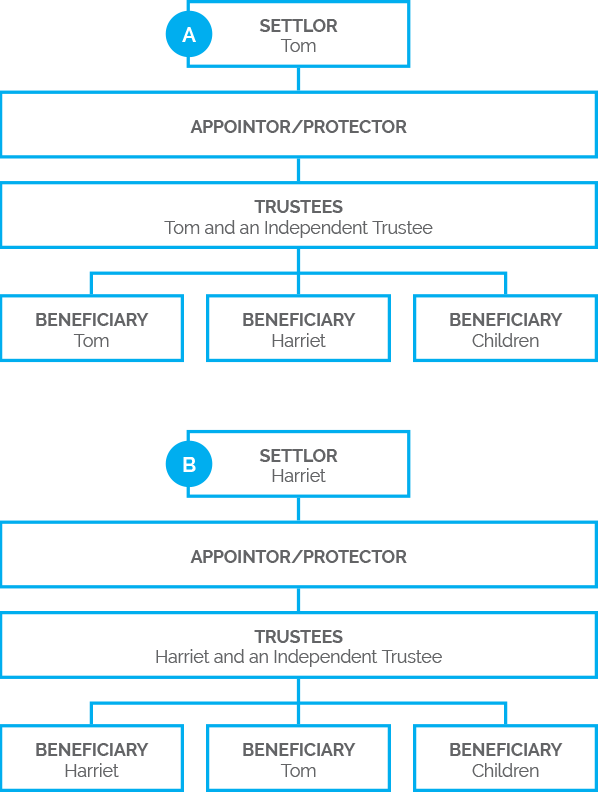

Parallel Trusts are actually two trusts, one used for each partner.

Essentially the Parallel Trust should be considered by those who have disproportionate values in the assets they hold and have children from a previous relationship, have formed new relationships and is what we refer to as a Blended Family.

Here couples who are looking to protect their assets and want to ensure that their children will receive an equitable inheritance would establish a separate Trust for each partner.

For protecting your own children in a blended family

The blended family is becoming more of a common situation as unfortunately the statistics tell us many relationships fail and new ones are formed. The blended family occurs when couples enter a relationship and each partner brings to the live-in relationship children from their previous relationships.

Such couples who are looking to protect their assets and where each partner wants to ensure his or her own children will receive an inheritance, will look to establish a Parallel Trust structure. Each partner will establish their own Trust and move their assets into their Trust providing for their partner’s interests to be protected but also ensuring inheritances will pass to the children of the deceased.

For a surviving partner to use shared assets

In the event of the death of one partner, pursuant to the terms of the Will and Memorandum of Wishes of the deceased, the surviving partner can have access to the assets held in the deceased’s Trust. If that asset was say a share in the house, the survivor will have the right to continue living in the house, as stipulated in the deceased’s Will.

Both partners make this provision and they will stipulate when it is to cease, say when the survivor dies, forms another relationship in the nature of a marriage, moves out of the house or on the deceased’s children reaching a certain age. The survivor may also be entitled to take income from the deceased’s Trust subject to limitations i.e. termination on any of the above events happening.

For protecting assets from unwanted beneficiaries

One of the pet fears of both couples and parents is the “gold digger” appearing on the scene and eventually walking away with the “loot”. The laws of New Zealand allow for the splitting of relationship property equally if the relationship has lasted for more than 3 years. If going into a relationship or in fact leaving a relationship, the Parallel Trust will provide protection from assets passing to a partner and as a consequence being lost to your children.

For one partner to protect a large asset base

Should one partner own a larger share of the assets of a couple, a Parallel Trust is an ideal vehicle to protect those assets for the benefit of his/her children.

For example, if one partner brings $300,000 to the relationship and the other $450,000, both amounts are used to buy a house and the relationship fails later, the value may be split equally thus disadvantaging the partner contributing the larger amount.

However, if the funds are advanced from their respective Parallel Trusts, one partner will have contributed $300,000 (40%) and the other $450,000 ( 60% ) of the cost. One Trust will therefore own 40% of the house and the other 60%. These proportionate amounts will be protected under the Trust’s terms for the benefit of each Trust’s beneficiaries.

For peace of mind with your Parallel Trust…

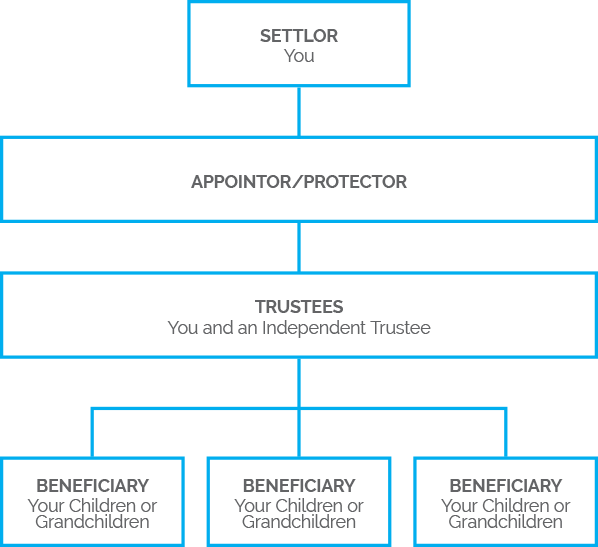

A special purpose Trust which typically differs from normal Family Trusts in that the Single Trust may have a single Corporate Trustee rather than family members directly, or may list specific Trusts as beneficiaries rather than family members.

These types of Trusts are used to differentiate specific business activities from normal business functions or to isolate specific assets for specific purposes.

This Trust would be used by a single person who is just starting to acquire assets such as their first home and want to use the Trust to keep their assets separate from future relationships. They should also be considered by people just exiting a relationship and who want to ensure that their assets are keep separate from a future relationship.

For separation of Business Activities for Tax reasons

Special tax rules may apply to certain sources of income. It may be desirable from a tax perspective to separate out these sources of income from general income. Use of an Investment Trust would give a clear line of separation between the two sources of income. As in any tax planning matters, accountants should be consulted.

For separation of Property for relationship property reasons

An Investment Trust may be used to hold a particular asset thus keeping it protected from being classified as “relationship property”. Using a sole independent Trustee, or not listing individuals as beneficiaries, could provide an extra level of separation from a relationship claim. As we know, relationship property will usually be divided in half if a relationship fails after 3 years.

For risk management for business purposes

Holding a specific asset in a special purpose Investment Trust may be a prudent measure for reducing risk in a business environment. Limited liability Companies do have some protection from creditors but often that protection is removed by the giving of personal guarantees by Company owners or through liability as a director. Placing specific assets into Investment Trusts may separate those assets from assets that are under control of the Company Director and provide the protection that Trusts give in such circumstances.

For peace of mind with a Single Trust…

PERMANENCE

New Zealand Trustee Services Limited has the ability to continue in perpetuity unlike private trustees who may lose their capacity to act.

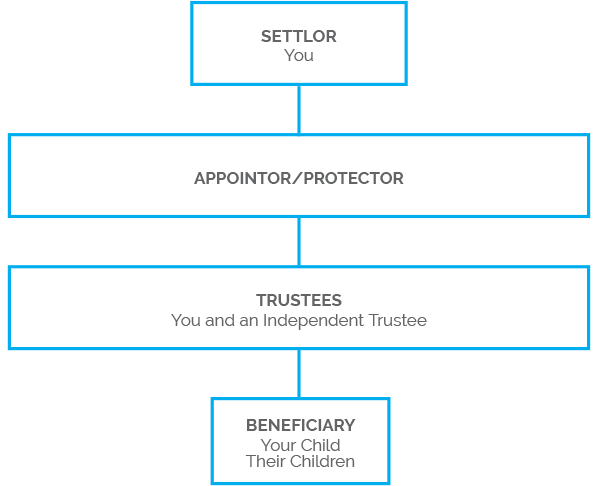

NextGen Trusts are created by parents for the benefit of the child. It provides certainty and security that the assets left to the child will be protected for the next generation no matter what the future holds. It is a common misconception that these Trusts are only of any benefit to the child when the parents pass away. In reality, the NextGen Trust offers benefits throughout a child’s lifetime and can be utilised at any stage, even while the parents are still living.

NextGen Trusts are ideal for:

- Parents of younger children who want to ensure protection from future relationships, business partners, creditors or others and who want to make provisions for their passing.

- Parents with older children who are starting to aquire assets and wish to keep those assets separate from joint assets of a future relationship and other risks or challenges.

- People expecting to inherit assets and wishing to keep them separate from relationship funds.

PROVIDING FOR CHILDREN

Estate planning includes ensuring family assets pass down the chain to future generations and are not lost to business failure, relationship failure and the like. Starting a NextGen Trust early in your child’s life is an ideal way to give them a more secure future.

Unfortunately businesses do fail as do relationships and without sound estate planning, outside parties can and do receive ownership of hard earned family assets that would preferably pass down the generations. NextGen Trusts are used to ensure the family wealth is passed from generation to generation within the protection of the Trust. After all, it is preferable that your children enjoy the benefits of your family’s wealth instead of someone else.

Beware the gold digger!

STARTING OUT

If your child is just starting to acquire assets such as a first home, you may want to consider the impact of future relationships on the ownership of his or her assets.

Remember that if a relationship is in existence, the assets brought into the relationship may well be treated as joint assets and split equally if the relationships fails.

Additionally, If inheritances are likely to form part of your child’s assets, ideally your inheritances would be directed to a NextGen Trust and held under the protection of that Trust.

INHERITANCES

Many people will receive inheritances from their parents or other family members and unfortunately, in many cases, those inheritances pass directly into the ownership of the beneficiary.

We see, too often, the inheritance becoming intermingled with relationship property and if the relationship fails, split equally with the former partner claiming his/her half share of the assets.

Also in a business environment, claims by creditors can result in inheritances from family having to be used to settle these claims.

The formation of a NextGen Trust to receive inheritances directly from the family member on their passing will protect the inheritance from such claims and will allow the beneficiary to enjoy the inheritance into the future.

BUSINESS FAILURE AND CREDITORS

Business people’s assets will usually be up for grabs if a business fails, creditors bring claims against the business and personal guarantees are called in. For these reasons, sound planning will ensure that as much protection as possible is given to all assets by the use of Trusts, amongst other planning tools.

Imagine how demoralising it would be to receive an inheritance from parents only to see it lost if your business fails.

This can be avoided if the inheritance is distributed directly to a NextGen Trust and thus protected from creditors.

Whilst asset protection is also the purpose of Business Trusts, efficient tax planning and business succession issues are motivators in establishing Business Trusts.

Here we look to separate out Business Assets from the Family Assets. The Business Trust should hold shares in a Private Company therefore allowing dividends to pass to this Trust, which in turn can be distributed to that Trusts Beneficiaries (this should include your Family Trust/Parallel Trust or Single Trust). It will also allow the growth of the Company to be retained within the Trust and not to the former shareholder which presumably was you.

For personal asset protection

One of the worst case scenarios for business people is to witness the decline and failure of their business and the consequent loss of all personal assets in the event of receivership. The protection offered by a Business Trust will go a long way to alleviating this situation. Creditors and receivers have the ability to make claims on personal assets, including the family home, if the structure of the business operation is inappropriate and intermingling of personal and business assets has occurred. As Business Trusts tend to be more active, they are more open to challenge and if dismantled because they are considered a sham, the family home can be put at risk if it is a part of the Business Trust. For this reason, Business Trusts should hold the business assets and Family Trusts the family assets. Protection of the family home above all other considerations is most likely to be paramount and a Business Trust will allow for this to happen.

For business asset protection

In the event of businesses failing, or business creditors taking action for settlement of outstanding debt, unless proper planning has been implemented, personal assets can be exposed to loss. NZ is made up of many tens of thousands of small businesses, most of which conduct their business as a limited liability company. However the protection of limited liability is often removed when lenders to the business require personal guarantees of the business owners. Often this is the businesses bankers. For this and other reason, savvy business owners will establish a Business Trust and move their shares in the business into the trust thus ring fencing them and offering them the protection of a trust structure. Business assets are separated from family assets in the event of business failure or legislative change and it is the business assets alone that are vulnerable to claims. Also, if the shares in a new company are transferred to a Business Trust, the value of the transfer can often be minimal and the Business Trust will own the future growth in the share value. On retirement or sale of the business, the value of the asset is in the Trust where it should be.

For business succession planning

Too often a business will stumble, falter and even fail completely when a business partner dies or becomes seriously disabled. The succession planning of business owners can be greatly enhanced by the use of Business Trusts but too often we see inappropriate ownership of the Company’s shares, inadequate or no buy-sell agreements in place, inadequate or no life and disability cover on the principals and other weird and wonderful business structures in place. A properly constituted buy sell agreement, correctly documented and supported by appropriate life and disability cover and ownership of the shares held in robust Business Trusts will allow for a desirable succession plan to occur should disaster strike. The Business Trust is an integral part of this planning.

For tax efficiency

The import of tax in both personal and business situations should be minimised as much as possible and legally allowable. Once again, Business Trusts can play a prominent part in minimising tax. Often a principal business operator will be paying tax at the highest rate. In general terms, dividends flowing from a Company to a Business Trust in which a family trust is a beneficiary may allow the income from the company to be split amongst beneficiaries of the family trust who are taxed at lower rates. Usually transferring assets to a Trust requires a lengthy gifting programme. This can be dramatically shortened if dividends in the Company are capitalised, and used to repay debt to the settlor.

For peace of mind with your Business Trust…

A Charitable Trust is a legal structure which acts as your vehicle for philanthropic giving. It is specifically designed for charitable purposes, whether it relates to the relief of poverty, the advancement of education or religion, or any other matter beneficial to the community.

NZ Trustees are pleased to work in partnership with Perpetual Guardian, a specialist in managing a range of charitable vehicles which can help you define, secure and, if needed, perpetuate your charitable intentions.

The desire to give comes from the heart, but the ability to make an ongoing difference comes from sound thinking and careful planning. We have the expertise and experience to assist you in becoming more thoughtful and intentional in your giving so that your personal philanthropy will have greater impact. For further information please go to: www.perpetualguardian.co.nz/philanthropy/overview